How to Build a DeFi Bot with No Tech Skills and Zero Coding

The world of Decentralized Finance (DeFi) has exploded over the past few years, bringing new opportunities for passive income, financial freedom, and a unique way to participate in the cryptocurrency ecosystem. One exciting development is the use of DeFi bots, which automate tasks like trading, yield farming, and liquidity provision. The best part? You don’t need any technical skills or coding knowledge to build a DeFi bot. In this article, we will walk you through the steps on how to build a DeFi bot with no tech skills and zero coding.

What is a DeFi Bot?

Before diving into how to build a DeFi bot with no tech skills, let’s first understand what a DeFi bot is. A DeFi bot is a software program that interacts with decentralized protocols and platforms to perform specific tasks autonomously. For example, a DeFi bot can be used to trade tokens on decentralized exchanges (DEX), stake cryptocurrencies, or provide liquidity in exchange for rewards—all without the need for constant monitoring or manual intervention.

These bots work on various platforms like Ethereum, Binance Smart Chain, Solana, and others, leveraging smart contracts to execute actions on the blockchain.

Why Build a DeFi Bot?

Building a DeFi bot offers numerous advantages, including:

- Automation: DeFi bots can automatically perform tasks without the need for human intervention.

- 24/7 Operation: Bots can work around the clock, ensuring you never miss a profitable opportunity.

- Efficiency: Bots can perform tasks faster and more accurately than humans.

- No Coding Required: With the right tools, anyone can create a DeFi bot without having to write a single line of code.

Now that you understand the basics of DeFi bots, let’s walk through how to build a DeFi bot with no tech skills and zero coding.

Step 1: Choose the Right DeFi Platform

To begin building your DeFi bot, you first need to choose the right platform to work with. There are several platforms that allow you to create and deploy DeFi bots without needing coding knowledge. Some popular options include:

- 3Commas: A user-friendly platform that supports automated trading for various cryptocurrencies. It allows users to build bots to execute trading strategies on multiple exchanges.

- Pionex: A crypto exchange with built-in trading bots. Pionex offers a variety of automated trading options, such as grid bots, DCA bots, and smart trade bots.

- Zerion: A platform that allows users to track their DeFi investments and build automated strategies without coding skills.

- Furucombo: A tool that lets users create automated DeFi strategies by dragging and dropping blocks, making it an excellent choice for non-technical users.

When choosing a platform, consider factors like supported assets, fees, ease of use, and available integrations with DeFi protocols.

Step 2: Define Your Goals

Before you start building your bot, it’s essential to have a clear idea of what you want to achieve. DeFi bots can be used for various purposes, such as:

- Automated Trading: Bots can execute buy and sell orders on decentralized exchanges based on predetermined strategies like market trends or price levels.

- Yield Farming: Bots can automatically stake your tokens in liquidity pools to earn rewards, or they can move funds between different platforms to maximize returns.

- Arbitrage: Bots can take advantage of price discrepancies between different DeFi platforms, buying low on one platform and selling high on another.

Take some time to research and determine your goals. This will help you choose the right bot-building tool and configure it properly.

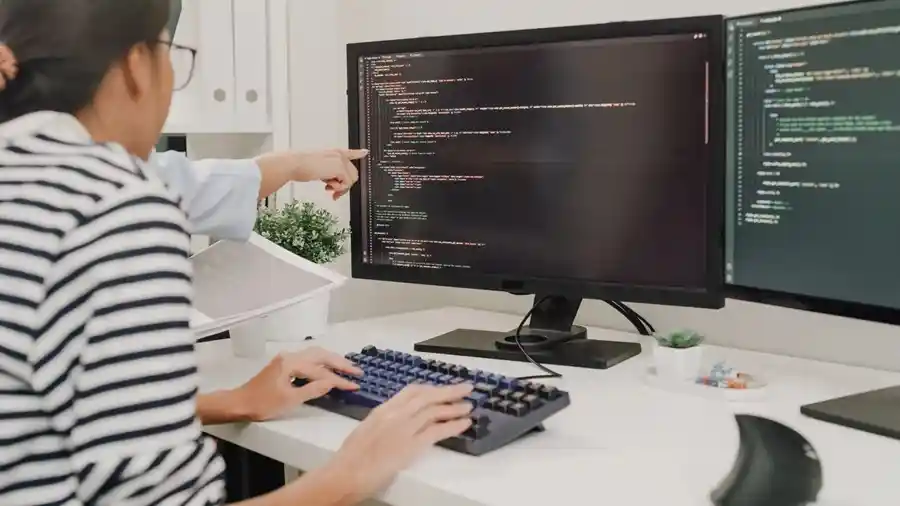

Step 3: Use No-Code Platforms to Build Your Bot

Once you’ve chosen a platform and defined your goals, the next step is to build your bot. Thankfully, there are several no-code platforms available that allow you to design your DeFi bot without writing a single line of code. These platforms provide intuitive interfaces and drag-and-drop functionality to simplify the process.

For example, Furucombo allows you to create custom DeFi strategies by selecting pre-built “combos” (or blocks), such as swapping tokens, providing liquidity, or executing trades. You can mix and match these blocks to build a strategy that fits your needs.

Similarly, platforms like 3Commas offer customizable trading bots that can be set up with just a few clicks. You can choose from different strategies, including trend following, arbitrage, and grid trading, without any technical skills.

Step 4: Set Up Your Bot’s Parameters

Now that you have built your bot, it’s time to configure its settings. This step is crucial because it dictates how your bot will behave and the tasks it will execute.

Some of the key parameters you will need to set include:

- Trading Pairs: Choose which cryptocurrencies your bot will trade. For example, you might choose to trade Ethereum (ETH) against USDT (Tether).

- Risk Management: Set limits on how much capital the bot can use for each trade or transaction. You can also set stop-loss and take-profit levels to protect your investment.

- Frequency and Timing: Decide how often the bot should check for new opportunities and execute trades. You can set it to trade in real-time or on a schedule.

- Slippage Tolerance: This refers to the difference between the expected price of a trade and the actual price. Set an acceptable slippage range to ensure the bot doesn’t execute trades that are too far from the expected price.

Once you’ve configured these parameters, test your bot with small amounts of capital to ensure it behaves as expected.

Step 5: Monitor and Optimize Your Bot

After your DeFi bot is up and running, it’s important to monitor its performance regularly. Even though the bot is designed to work autonomously, you still need to track its performance and make adjustments if necessary.

Keep an eye on the following:

- Profit and Loss: Check if your bot is making the profits you expect. If not, consider adjusting its strategy or settings.

- Market Conditions: The DeFi space is constantly changing. If there are significant market shifts, you may need to tweak your bot’s strategy to adapt.

- Bot Settings: Occasionally review and update your bot’s parameters, especially as you become more familiar with its performance.

Conclusion

Building a DeFi bot with no tech skills and zero coding is not only possible, but it’s also easier than ever. By using the right platforms, defining clear goals, and configuring the bot’s parameters, anyone can start automating their DeFi strategies. Whether you’re looking to trade, stake, or take advantage of arbitrage opportunities, a DeFi bot can help you achieve your financial goals in the crypto world.