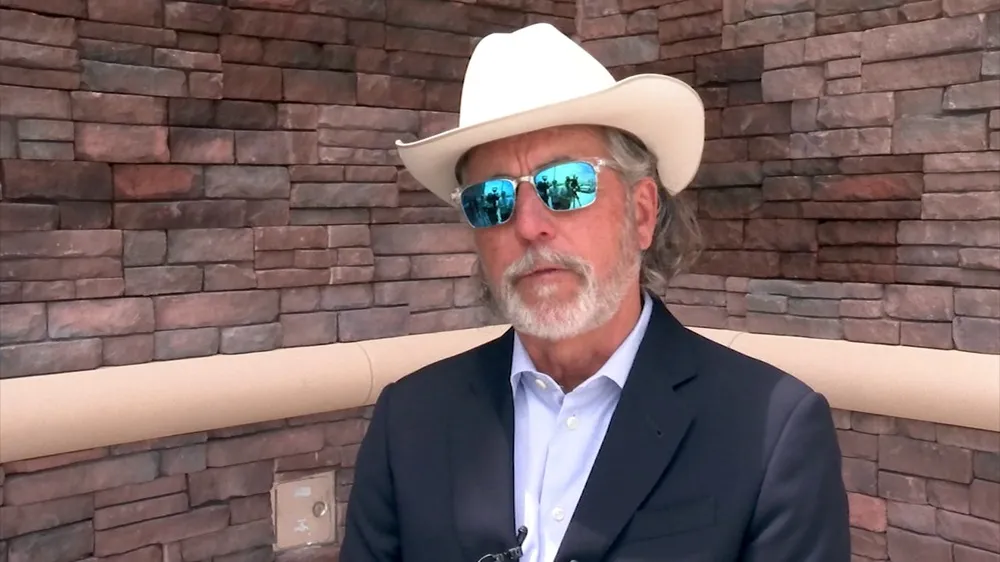

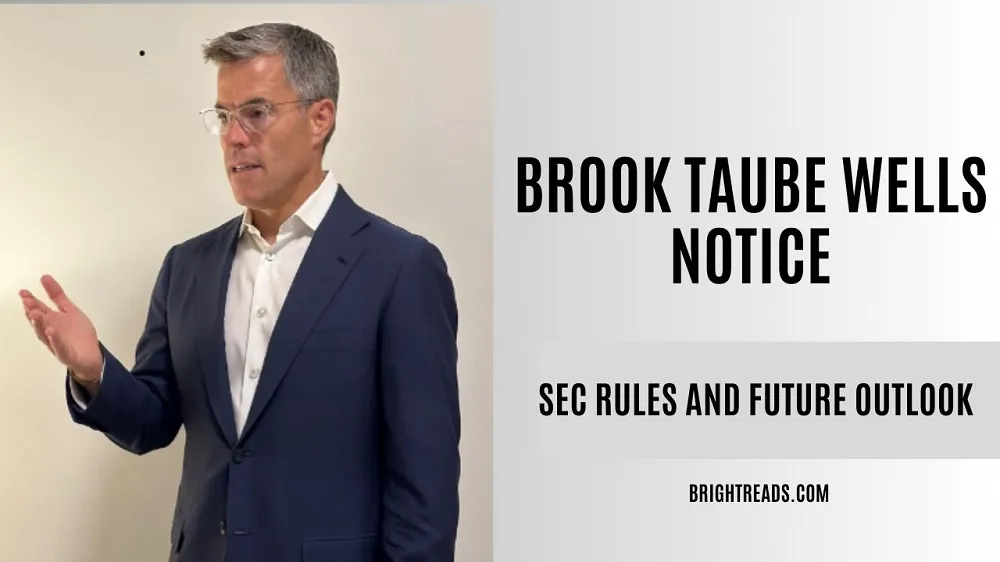

Brook Taube and the Wells Notice: Regulatory Challenges Unveiled

Brook Taube, a unmistakable figure in the monetary segment, has as of late found himself in the middle of a administrative storm including the issuance of a Wells Take note. This article investigates the concept of a Wells Take note, its suggestions, and how it relates to Brook Taube’s progressing legitimate and administrative challenges. By diving into the complexities of this legitimate device, we will way better get it how it capacities, why it is critical, and how it has influenced people like Brook Taube in their careers.

What is a Wells Notice?

A Wells Take note is a formal communication issued by the U.S. Securities and Trade Commission (SEC) or other administrative bodies to advise an person or company that the organization has completed its examination and found adequate grounds to bring an authorization activity for infringement of securities laws. Named after the Wells Report, a handle named after previous SEC official John Wells, this take note gives the beneficiary an opportunity to react some time recently formal charges are filed. The reason of the Wells Take note is not to charge the beneficiary of wrongdoing by and large but to alarm them to the plausibility of authorization activities. When an person, like Brook Taube, gets such a take note, it implies that the administrative organization accepts there is plausible cause to charge them with abusing securities controls. The beneficiary at that point has a chance to react to the affirmations by displaying prove or contentions to illustrate their guiltlessness or moderate the charges.The Part of Brook Taube in the Budgetary Sector

Brook Taube is a well-known official and budgetary proficient with an broad career in venture administration, especially inside support reserves and private value. All through his career, he has picked up a notoriety for his administration aptitudes, budgetary intuition, and inclusion in high-profile bargains. As the author of a few money related firms, Taube has driven major speculation methodologies and is recognized for his vital decision-making in complex monetary environments. Given the conspicuousness of his career, any administrative activity against Brook Taube is a matter of noteworthy open and industry intrigued. The Wells Take note issued to Taube speaks to not as it were a individual challenge but too a broader issue approximately administrative oversight in the monetary industry, especially in connection to support finance administration, private value, and speculation transactions.Understanding the Wells Take note in Context

The Wells Take note handle is a basic component of the SEC’s requirement procedure. Administrative bodies like the SEC utilize this instrument to hold people and companies responsible for breaches of securities law. These laws are outlined to guarantee straightforwardness, decency, and keenness in the monetary markets, securing financial specialists from false hones, insider exchanging, advertise control, and other shapes of misconduct. In the case of Brook Taube, the Wells Take note serves as a take note of a pending legitimate prepare where the SEC has supposedly found sufficient prove to propose that Taube may have been included in exercises that damage securities laws. In any case, getting a Wells Take note does not naturally infer blame. It is a formal step in an progressing examination, giving Taube with the opportunity to challenge or challenge the SEC’s discoveries some time recently authorization activities are initiated.How a Wells Take note Influences the Individual or Substance Involved

For somebody like Brook Taube, the receipt of a Wells Take note has far-reaching results. To begin with, it serves as a open affirmation of potential wrongdoing, indeed if that wrongdoing has not however been formally demonstrated. This can cause noteworthy harm to a professional’s notoriety, influencing their standing in the monetary community, their connections with financial specialists, and their capacity to secure future trade opportunities. Moreover, a Wells Take note regularly triggers legitimate fights, with the beneficiary requiring to enlist lawful specialists and experts to explore the complex administrative environment. These procedures can be exorbitant, time-consuming, and candidly depleting. For somebody like Taube, who is known for his entrepreneurial soul and administration in back, such challenges may moreover result in a reconsidering of career course and priorities.The Lawful and Money related Affect of a Wells Notice

The legitimate suggestions of getting a Wells Take note can be considerable. If Brook Taube or any beneficiary of the take note is incapable to effectively challenge the discoveries, the SEC may continue with an authorization activity that might incorporate respectful punishments, fines, or indeed a boycott from taking part in certain budgetary exercises. The results for people included in high-profile budgetary firms can amplify past the coordinate lawful punishments. A harmed notoriety can lead to work misfortune, client withdrawal, and open scrutiny. In a few cases, the issuance of a Wells Take note can too affect the broader money related advertise. Budgetary firms related with people beneath examination frequently encounter instability, as speculators may pull back stores or put future speculations on hold. The vulnerability made by a Wells Take note can in this way influence whole portfolios and venture procedures, particularly if key officials like Brook Taube are at the helm.The SEC’s Investigative Prepare and Brook Taube’s Case

The SEC’s examination into people like Brook Taube regularly takes after a particular handle that leads up to the issuance of a Wells Take note. This handle can be broken down into a few stages: Initial Request and Examination: The SEC starts its examination when it gets a tip, complaint, or marker of potential infringement of securities laws. This seem come from different sources, counting whistleblowers, reviews, or advertise observation. If the SEC regards the matter commendable of encourage examination, it opens an request and accumulates evidence. Issuance of Subpoenas and Record Survey: Amid the examination, the SEC has the specialist to issue subpoenas to collect records, ask interviews, and accumulate significant data. In the case of Brook Taube, this might incorporate looking into budgetary records, exchange points of interest, communications, and other shapes of documentation that might give knowledge into whether securities laws were violated. Wells Accommodation: Once the SEC has assembled sufficient prove to recommend a infringement has happened, the Wells Take note is issued. The beneficiary, such as Taube, is given the opportunity to yield a Wells Accommodation, which is their chance to contend against the charges and show prove in their defense. This accommodation can include giving lawful contentions, showing master declaration, or refuting the SEC’s findings. Evaluation of Wells Accommodation: The SEC assesses the reaction and decides whether to continue with authorization activities. The last choice may include encourage arrangements, settlement talks, or a formal complaint if the SEC chooses to seek after the case in court.Regulatory Challenges Confronted by Brook Taube

For Brook Taube, like numerous other monetary experts, administrative challenges show a fragile adjusting act. On one hand, administrators and speculators are anticipated to drive victory, develop resources, and maximize returns for partners. On the other hand, they must comply with an progressively complex and advancing set of laws and controls outlined to guarantee moral behavior and advertise integrity. In this setting, Brook Taube’s circumstance raises a few critical questions approximately the part of control in the budgetary industry:1. The Part of Individual Responsibility:

Financial experts are depended with huge entireties of cash, and they are anticipated to take after the law to ensure financial specialists. Be that as it may, when administrative breaches happen, how much of the obligation lies with the person versus the broader organization they are portion of? This is a basic address in understanding the challenges confronted by figures like Taube, particularly in light of administrative oversight that can some of the time be unclear or troublesome to navigate.2. Adjusting Advancement and Compliance:

The monetary segment is profoundly competitive and fast-paced, and advancement plays a key part in driving showcase victory. In any case, money related experts must strike a adjust between inventive procedures and adherence to legitimate and moral benchmarks. The administrative scene is regularly moderate to adjust to the fast changes inside budgetary markets, taking off experts like Brook Taube at times strolling a fine line between lawful development and potential violations.3. The Affect of Administrative Uncertainty:

The ever-evolving nature of budgetary direction frequently makes instability in the advertise. The SEC and other controllers must keep pace with modern money related disobedient, advertise hones, and advances. In such a scene, a well-meaning proficient like Taube seem incidentally cross administrative boundaries due to moving benchmarks or advancing requirement priorities.Conclusion

A Broader Reflection on Money related Regulation The case of Brook Taube and the issuance of the Wells Take note highlight the complexities and challenges of exploring the monetary segment beneath the examination of administrative bodies like the SEC. Whereas the Wells Take note is an fundamental instrument for authorization, it underscores the fragile nature of administrative compliance in a fast-moving industry. For people like Brook Taube, who are profoundly inserted in the monetary world, confronting a Wells Take note can serve as both a individual and proficient intersection. The take note speaks to more than fair a lawful challenge; it speaks to a broader discussion almost how the money related industry must adjust advancement, moral conduct, and administrative oversight to keep up believe and astuteness in the markets. As the administrative scene proceeds to advance, it is vital for money related experts to remain educated, stay tireless in their compliance endeavors, and get it the results that can emerge when the line between legitimate and unlawful monetary behavior gets to be obscured.Read More latest Posts

- Mirko MHA: The Unstoppable Hero Who Will Do Anything for Justice

- Fairy Tail Wiki: Uncovering the Secrets of the World’s Strongest Guild

- Raditz: The First Major Threat in Dragon Ball Z’s Legendary Saga

- Imu One Piece: The Mysterious Leader Who Could Be the Biggest Threat

- Cat Nap Poppy Playtime: The Scary Yet Adorable Creature You’ll Never Forget